Business Tax Id Ct

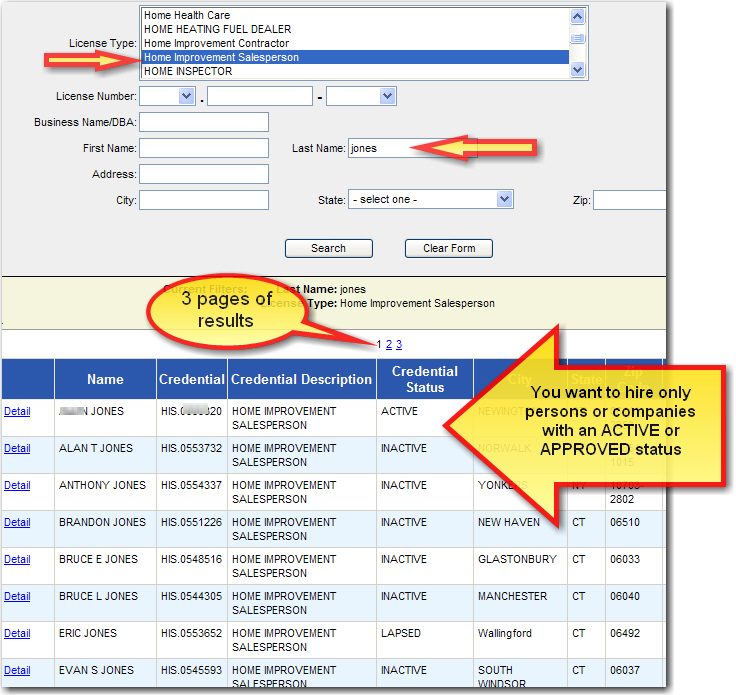

The wild card search can be done on Business names using the asterisk symbol. The most popular way to lookup a business is by Name.

Town Of Orange Tax Bills Search Pay

Generally returns are due on or before the fifteenth day of the fifth month following the end of the corporations taxable year May 15 for calendar year corporations unless your end date is June 30 which.

Business tax id ct. Search by Business ID. Corporation Business Tax Filing Requirements. Register your business today.

Some states require a separate state tax ID number. Youll need a Connecticut state tax ID if youre going to sell taxable products and services if youre going to owe excise taxes or if youre going to hire employees in the state of Connecticut. Obtaining a Tax ID Number EIN When starting a business in Connecticut serving as the administrator or executor of an estate creator of a Trust or operating a Non Profit Organization obtaining a Tax ID EIN is a key responsibility.

An EIN is to your Connecticut LLC what a Social Security Number is to a person. Connecticut Business Registry Search. This provides Connecticut with an accurate public record of your business.

MyconneCT is the new online hub for business tax needs. Your one stop for doing business in Connecticut. Sign in and use CTPLs brand new payment portal.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. All businesses with business name starting Hartford will be displayed. The Confirmation Number will serve as an official acknowledgement that your application has been received by DRS and act as your temporary tax identification number.

In all likelihood your business will need both a federal tax ID and a Connecticut state tax ID. Other states use the Federal Tax ID number. Number of Records per page.

Department of Revenue Services. Search by Filing Number. This search covers all domestic formed in Connecticut and foreign formed outside of Connecticut entities on record.

Department of Administrative Services. Visit myconneCT now to file pay and manage the following tax types. Having an EIN for your Connecticut LLC allows you to open a separate bank account under the LLCs name apply for certain licenses and permits and handle employee payroll if applicable.

The responsible party is the. Search for business name Hartford. Looking for something specific.

Both your individual SSN and your business EIN are nine digits. If your business needs a Connecticut state tax ID number youll first need to acquire a federal tax ID number EIN. You will need to use your EIN when registering with the Department of Labor.

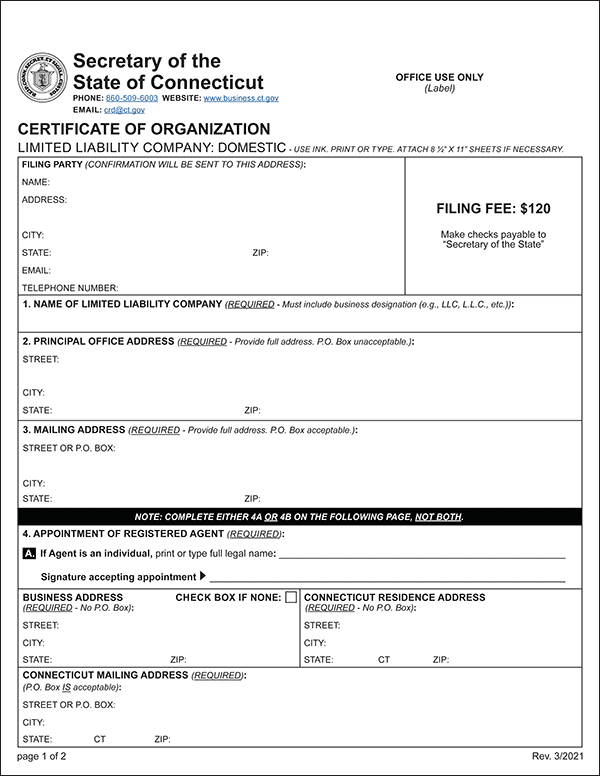

You will be able to preform your search by Name Business ID or Filing Number. You will receive your registration package with your permanent Connecticut tax registration number in approximately 10-15 business days. A corporation must electronically file Form CT-1120 Connecticut Corporation Business Tax Return if it carries on business or has the right to carry on business in Connecticut.

The first payment to the Connecticut Paid Leave fund is now due. The Confirmation Number will serve as an official acknowledgement that your application has been received by DRS and act as your temporary tax identification number. Sales and Use Business Use.

The good news is you can complete the entire process online here at Business One Stop. Only the Connecticut Department of Revenue Services can issue Connecticut tax registration numbers for sales tax withholding tax and all other state taxes we administer. Connecticut Cities and Towns Listings.

You will receive your registration package with your permanent Connecticut tax registration number in approximately 10. When opening a new business in Connecticut its important you register your business with the State. Businesses that have a Connecticut Tax Registration Number CT REG can use the Taxpayer Service Center TSC-BUS to file pay view tax transactions and update the businesss account information.

In contrast EIN numbers take the form 12-3456789. We appreciate there are many important steps you. But SSNs and ITINs take the form 123-45-6789.

The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. Enter business name business ALEI or filing number. Now you can file tax returns make payments and view your filing history in one location.

Room Occupancy B. It helps the IRS identify your business for tax and filing purposes. Common names for the EIN include.

You may apply for an EIN online if your principal business is located in the United States or US. A Tax ID also known as an Employer ID Number EIN is a unique nine digit number that identifies your business or entity with the IRS for tax purposes essentially like a Social Security Number for. If you do not have a Connecticut Tax Registration Number or need to register additional locations register your business online.

In Connecticut businesses that hire employees must register with the Connecticut Department of Labor for unemployment insurance tax. In most cases you are required to get an Connecticut or state permit or business license even if you are working from home or you have an online business or selling on eBay- but note. Register a New Business.

999 percent of all businesses are required to have a business license or business tax registration certificate both the same. You are limited to one EIN per responsible party per day. Search any type of business entity in Connecticut corporation LLC partnership etc by using the Concord Secretary of States Website.

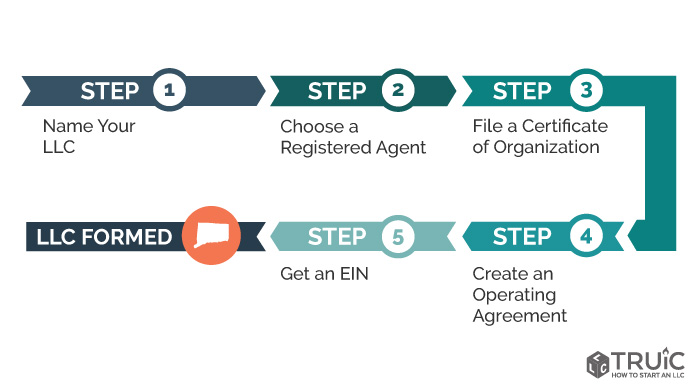

Connecticut Llc How To Start An Llc In Connecticut Truic

Https Windsorlocksct Org Wp Content Uploads 2021 02 Department Of Revenue Services Tax Filing Information Pdf

Https Portal Ct Gov Media Drs Taxworkshops Salestaxoverview Pdf La En

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

Connecticut Llc How To Start An Llc In Connecticut Truic

Connecticut Tax Id Ein Number Application Business Help Center

Https Portal Ct Gov Media Sots Step By Step Guide To Filing Annual Reports Pdf

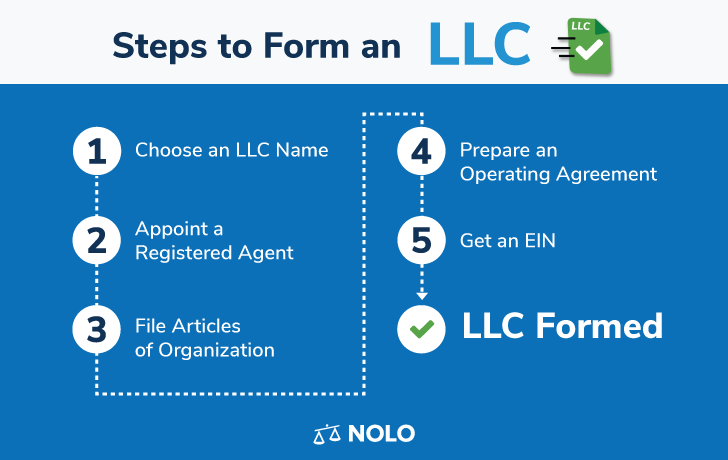

Llc In Connecticut How To Form An Llc In Connecticut Nolo

Town Of Orange Tax Bills Search Pay

Connecticut Llc How To Start An Llc In Connecticut Truic

Https Portal Ct Gov Media Drs Taxworkshops Salestaxoverview Pdf La En

Https Portal Ct Gov Media Dmv 20 29 K36pdf Pdf

Https Portal Ct Gov Media Drs Forms 1 2018 Misc Au 866 1018 Pdf La En

Connecticut Llc How To Start An Llc In Connecticut Truic

Https Portal Ct Gov Media Drs Rightnow Statusletters Tpg 170 Pdf

How To Dissolve An Llc In Connecticut Truic

Https Portal Ct Gov Media Doag Marketing Files 2015 Reg8pdf Pdf

Posting Komentar untuk "Business Tax Id Ct"