Business Tax Filing Deadline 2021 Extension

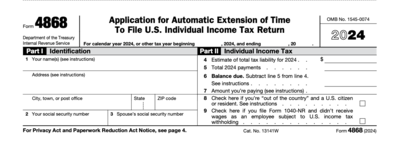

To request an extension to file your federal taxes after May 17 2021 print and mail Form 4868 Application for Automatic Extension of Time To File US. Deadline for corporate tax returns Forms 1120 1120-A and 1120-S for tax year 2020 or to request an automatic six-month extension of time to file Form 7004 for corporations that use the calendar year as their tax year and for filing partnership tax returns Form 1065 or to request an automatic six-month extension of time to file Form 7004.

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file.

Business tax filing deadline 2021 extension. So if your return due date was March 15 2021 an extension will give you until September 15 2021. However because the Internal Revenue Service already extended both filing and payment deadline to May 17 for the 2020 taxes filed in 2021 you got less than six months to file your return. Unfortunately additional time to file is almost over.

Need more time to prepare your federal tax return. Individual Income Tax Return. Form 7004 is used to request an automatic extension to file the certain returns.

The 2020 tax year created another reason confusion about the impact of COVID-relief aid and small business tax provisions from stimulus bills. In a typical tax year the reasons for filing a business tax extension range from incomplete books to being too busy running the business to focus on getting taxes done in time. This means that business owners who are annual filers will not need to complete a City of Seattle business tax return by January 31 2021 but instead must complete one by April 30.

Annual Tax Filing Deadline Changing From January 31 to April 30 Beginning with the year 2020 the deadline for annual business tax filers changes to April 30 2021. Find out where to mail your form. Washington unlike many other states does not have an income tax.

This extension does not affect estimated quarterly taxes which are still due April 15 2021 for non-employee income. Tax Extension Due dates for Business Tax Returns in 2021 S-corporation tax extension due date is 17th September 2021 no change in the due date Corporation tax extension due date is 15th October 2021 allowed automatic extension. Different types of business entities file tax returns in different ways.

If your business is set up as a partnership your tax return will be due on the 15th. If your business uses a calendar year-end of December 31 2021 your return or your extension is due to the IRS on or before March 15 2021. Here you can check your filing due dates to make sure your tax return gets in on time.

The IRS announced an extension to May 17 2021 of the deadline for filing individual income tax returns including those who pay self-employment taxes. The state BO tax is a gross receipts tax. The same rule holds true for partnerships.

This means there are no deductions from the BO tax for labor. If your business is organized as a partnership your income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. Depending on your entity type and fiscal year set-up the extension filing deadline is either Sept.

That means if you havent used the extra time to organize your books and collect all the necessary tax forms and paperwork you might be feeling a little stressed right about. Its important to know when your taxes need to be filed. For example if your partnership is a calendar year taxpayer with a December 31 year end you must file a 2020 tax.

We cant process extension requests filed electronically after May 17 2021. The tax filing extension deadline grants six additional months on top of the original filing deadline making the deadline to file taxes October 15. March 15 2021.

Washingtons BO tax is calculated on the gross income from activities. It is measured on the value of products gross proceeds of sale or gross income of the business. If your business is not covered by the IRS tax filing extension related to the February 2021 winter storm you can still get a six-month extension of time to file your return.

2015 Electronic funds transfer EFT 2021.

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Tax Returns Due May 17 Last Day To File Taxes Without Penalty 13newsnow Com

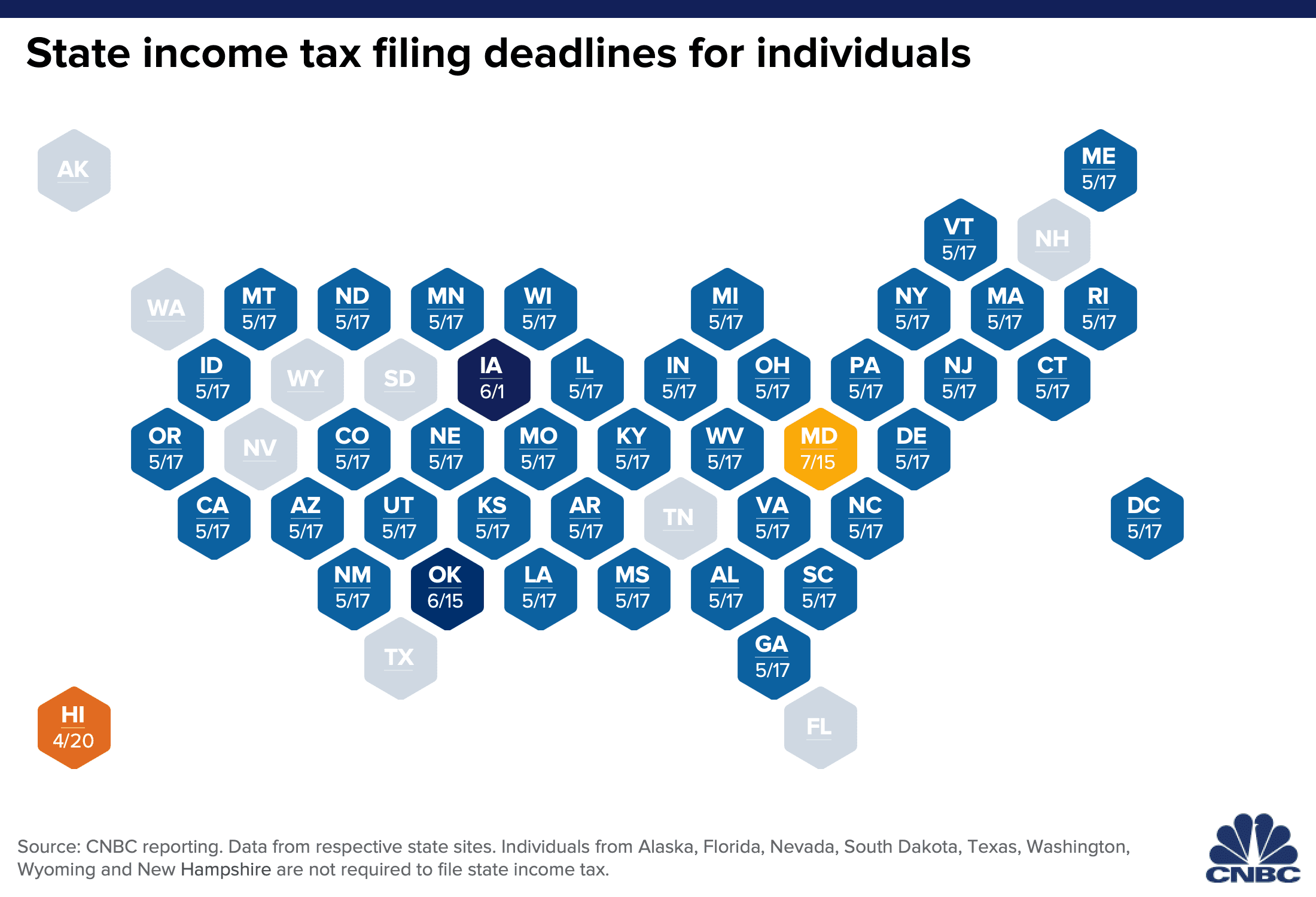

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

2021 Tax Filing Deadline For Texas Oklahoma And Louisiana

Pamplin Media Group Oregon Feds Extend Tax Filing Deadline To May 17

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

How To File An Extension For Taxes Form 4868 H R Block

Business Tax Renewal Instructions Los Angeles Office Of Finance

2021 Tax Deadlines And Extensions For Americans Abroad

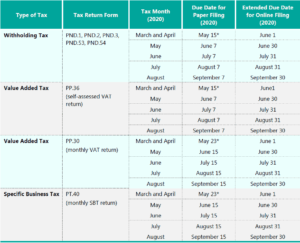

Further Extension For E Tax Filing In Thailand Tilleke Gibbins

E File An Irs Tax Extension E File Com

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Business Tax Deadlines In 2021 Block Advisors

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Us Tax Deadlines Updated For Expats Businesses Online Taxman

/ScreenShot2021-02-11at4.25.46PM-efc1304fa898450db5381a052fb0fcfe.png)

Posting Komentar untuk "Business Tax Filing Deadline 2021 Extension"