Maryland Business Tax Deadline 2021

2021 Maryland Sales Tax Table A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Personal property generally includes furniture fixtures.

Us Tax Deadlines Updated For Expats Businesses Online Taxman

This section supplies the latest information for business taxpayers.

Maryland business tax deadline 2021. No interest or penalty for late payment to be imposed if 2020 tax payments are made by July 15 2021. Electronic payments are voluntary for these three business tax types unless the payment is for 10000 or more in. Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation.

Tax laws vary by location and business structure check with federal state and local governments to find out your business tax obligations. Annual Report filing requirements. In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments.

Pay County and Municipal Real and Personal Property Taxes The Maryland Department of Assessments and Taxation values real and personal property owned by businesses and then certifies those assessments to. Box 17052 baltimore maryland 21297-1052. Personal property generally includes furniture fixtures.

Annual Report filing requirements. Employers filing annual reports must file on or before January 31 in the year that follows the year in which the income tax was withheld. 410-767-1170 888-246-5941 within maryland note.

No interest or penalties will be assessed on returns filed and taxes paid by April 15 2021. Please proceed with filing your Sales and Use Tax returns and payments for the July 2021 period. Please be advised that effective January 1 2021 all legal entities including foreign entities and domestic non-stock corporations will be required to file all past-due Annual Reports to revive reinstate re-register or re-qualify with the Department.

Click here for more information. The deadline for filing an application is October 1 2021. Franchot D on Thursday announced that he is extending the state income tax filing deadline by three months until July 15 2021.

Generally a claim for a refund amended return must be filed within 3 years from the date the original return was filed or within 2 years from the date the tax was paid whichever is later. For businesses struggling to make business-related tax payments due to COVID-19 closures and restrictions they should email taxpayerreliefmarylandtaxesgov. Sales Use Tax Direct Debit Payments.

Business Affairs Coronavirus News You Can Use Taxes and Revenues Comptroller Peter Franchot today announced that his agency has extended filing and payment deadlines for certain Maryland business taxes and quarterly estimated income tax returns and payments that would be due in January February and March 2021 until April 15 2021. RELIEF Act Tax Alert. You may see a delay in the debiting of your payment from your account.

Business Personal Property Taxes. The state income tax filing deadline for Marylanders has been extended by three months to July 15 2021. For more details please read our tax alert.

There are several options for businesses to file and pay Maryland income tax withholding motor fuel and corporate income taxes electronically. The state income tax filing deadline has been extended until July 15 2021. Before filling out this personal property return.

Due to water damage our Greenbelt Office is temporarily closed through Friday August 27 2021 We anticipate the office re-opening to the public on Monday August 30 2021 Please check back after Friday August 27 2021 for any further information Nominations are now being acccepted for the 2021 William Donald Schaefer Awards Click on the News menu and select Comptroller Initiatives to. No interest or penalties will be assessed if returns are filed and taxes. Nominations are now being acccepted for the 2021 William Donald Schaefer Awards Click on the News menu and select Comptroller Initiatives to download the form Entries are due no later than October 15 2021 BREAKING NEWS.

Our agency is currently processing all sales use tax payments scheduled for 71521 and after. Maryland business tax filing deadline 2021. Corporations and organizations that are allowed later due dates for federal returns under the Internal Revenue Code are allowed the same due date for Maryland income tax returns.

No interest or penalties will be assessed as long as returns are filed and tax es owed are paid by the new deadline. Box 8888 Annapolis MD 21401-8888. Business personal property tax return maryland state department of assessments and taxation taxpayer services division po.

Mar 11 2021 Maryland Comptroller Peter VR. Extension of Time to File. Please be advised that effective January 1 2021 all legal entities including foreign entities and domestic non-stock corporations will be required to file all past-due Annual Reports to revive reinstate re-register or re-qualify with the Department.

The Form 510 Pass-through Entity Tax Return only will allow a refund if there are no nonresident members and the amount on line 13 of the return is zero.

Tax Deadline Why You Do Not Want To Delay Filing Your Taxes Until May 17 The Washington Post

District Of Columbia Sales Tax Small Business Guide Truic

The Dual Tax Burden Of S Corporations Tax Foundation

Pay Business Taxes Maryland Business Express Mbe

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

2020 Tax Deadline Extension What You Need To Know Taxact

31st March Is The Last Day To File Your Income Tax Return For The Fy 2015 16 Fy 2016 17 Hurry File Your Itr Now 1 Income Tax Income Tax Return Tax Return

Irs Doesn T See A Need To Extend Tax Deadline Despite Pressure From Lawmakers

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

2020 Tax Deadline Extension What You Need To Know Taxact

Business Tax Deadlines In 2021 Block Advisors

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Although The 2020 Tax Filing Deadline Has Been Moved From The Standard April 15 To July 15 You Might Be Wondering What To Filing Taxes Tax Extension Tax Time

Kansas Department Of Revenue Business Tax Home Page

Pay Business Taxes Maryland Business Express Mbe

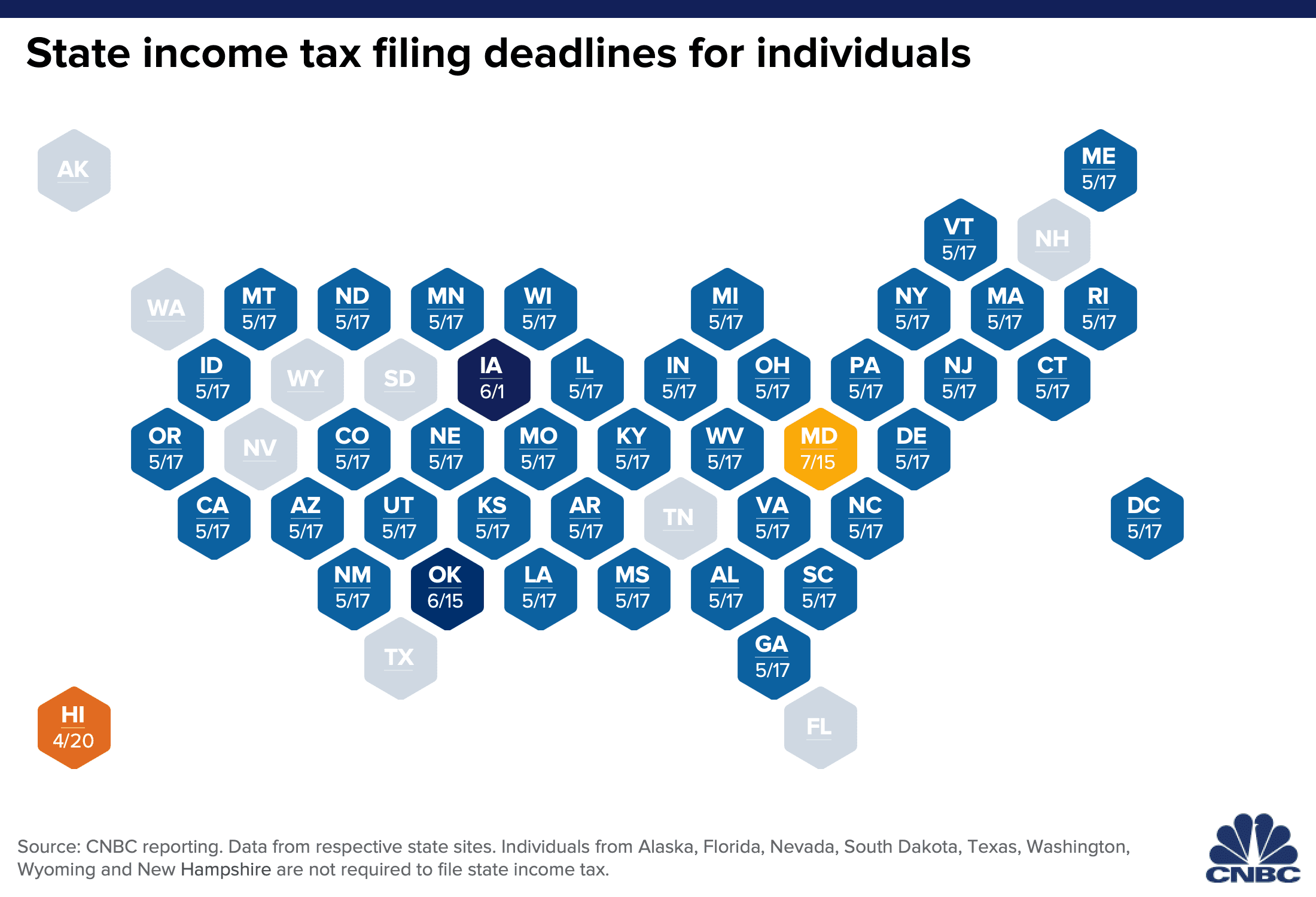

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Posting Komentar untuk "Maryland Business Tax Deadline 2021"